How to Use Best Buy Tables – And Why They’re Just the Starting Point

MP

When you're beginning your mortgage search, it's easy to get drawn in by Best Buy Tables. These tables—found on comparison sites or lender websites—are designed to give a quick snapshot of the most competitive mortgage deals available based on interest rates, fees, and overall cost. But while they can be a helpful tool, they don’t always tell the full story—especially if your circumstances fall outside the ‘standard’ borrowing criteria.

At Mortgage321, we believe in giving you a clear, informed perspective. So, here’s our guide to using Best Buy Tables—and when it’s time to go beyond them.

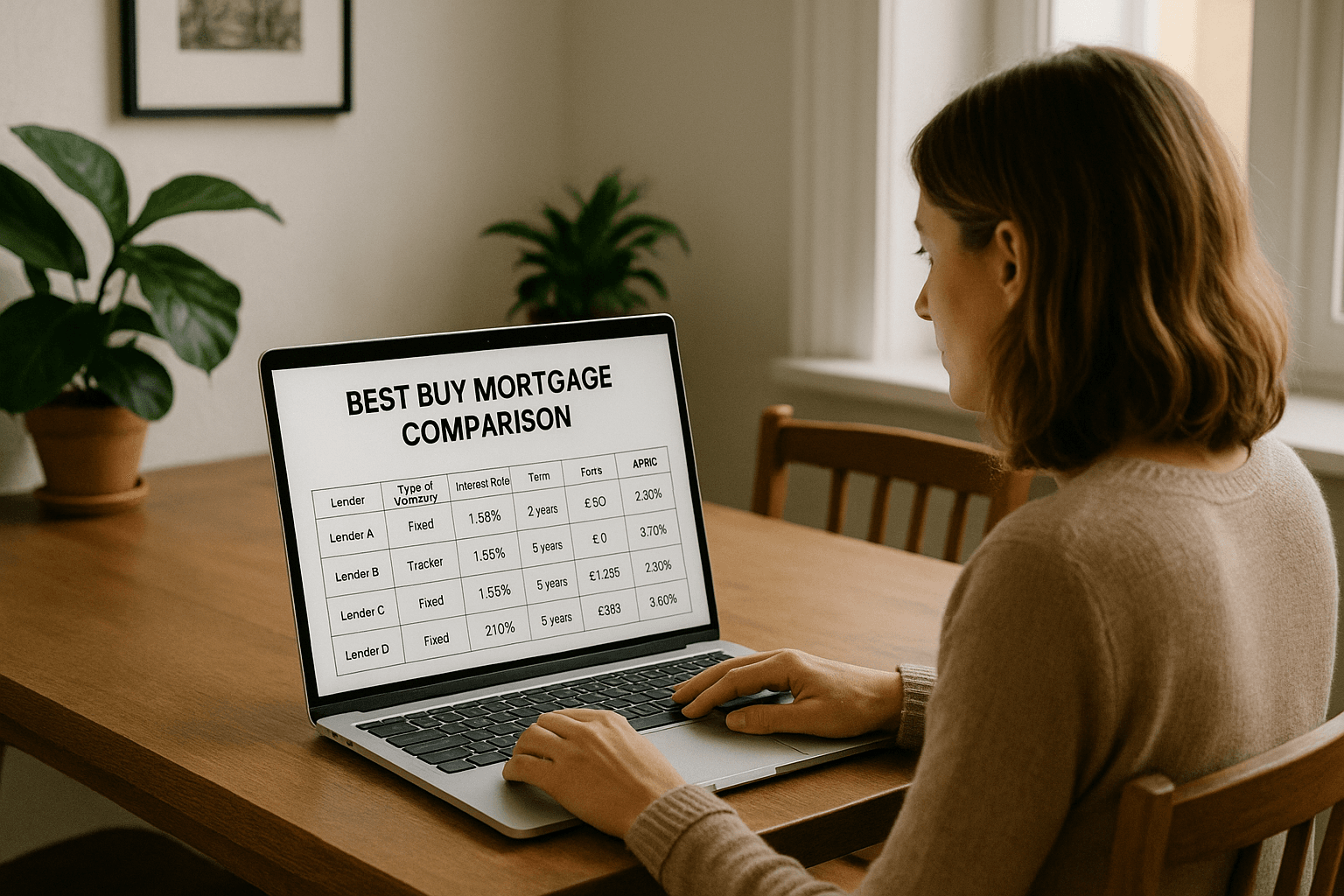

✅ What Are Best Buy Tables?

Best Buy Tables are simple comparison charts showing a selection of top mortgage deals, usually ranked by interest rate or initial monthly cost. They typically include:

- The lender’s name

- The type of mortgage (e.g., fixed, tracker)

- The interest rate and term

- The lender’s fees

- The APRC (Annual Percentage Rate of Charge)

- The initial monthly payment

Some tables even allow basic filters—like property value, loan amount, or repayment type.

They’re useful for building initial awareness and identifying potential mortgage products—but that’s where their usefulness ends for many borrowers.

🚫 Limitations of Best Buy Tables

While helpful at a glance, Best Buy Tables have significant limitations—especially for clients with non-standard scenarios:

- They assume “vanilla” criteria: These tables generally base results on ideal borrower profiles—clean credit, stable income, standard property types, and low LTV (loan-to-value).

- No room for complexity: If you’re self-employed, have adverse credit, own multiple properties, or are purchasing under value or via auction—Best Buy Tables don’t reflect lenders who specialise in these areas.

- Not tailored to affordability: Just because a rate looks competitive doesn’t mean the lender will agree to lend the amount you need. Every lender assesses affordability differently.

- Fees can distort true cost: A product with a low interest rate but a high arrangement fee may cost more overall than one with a slightly higher rate and no fee.

- Not all lenders are listed: Many specialist or intermediary-only lenders—those we regularly work with at Mortgage321—don’t feature in public comparison tools.

🔍 How We Use Best Buy Tables at Mortgage321

At Mortgage321, we do review Best Buy Tables as part of the initial market scan—but more importantly, we combine that data with over 30 years of specialist experience to assess:

- Your individual circumstances

- Your income structure (PAYE, self-employed, company director, portfolio landlord, etc.)

- Credit history and debt profile

- Property type (e.g., HMO, mixed-use, or commercial units)

- Purpose (purchase, remortgage, capital raising, bridging, etc.)

From there, we access a wider panel of lenders, including those who don’t appear on public tables—offering bespoke terms tailored to your needs.

🔐 Best Buy Doesn’t Always Mean Best Fit

The lowest rate isn’t always the best option. We regularly help clients who come to us after applying directly via a Best Buy Table—only to be declined due to:

- Historical credit issues

- Non-standard income (e.g. dividends, retained profits)

- Unusual property types

- Insufficient automated affordability

That’s where our tailored approach comes in. We focus on getting the mortgage that works for you, not just the one that looks good online.

💡 When Should You Speak to a Broker Instead?

If any of the following apply, it’s time to go beyond the table and speak to us directly:

- You’ve been declined by a high street lender

- You’re self-employed or have complex income

- You're looking at a buy-to-let, HMO, or commercial property

- You have adverse or limited credit history

- You’re raising capital for business or investment

- You’re considering a bridging loan or auction purchase

- You’re buying under market value or via gifted equity

👋 Let’s Make the Best Choice, Not Just the Best Rate

Best Buy Tables are a good starting point—but they’re no substitute for tailored advice. At Mortgage321, we take time to understand your full picture, then use our access to specialist lenders and industry knowledge to secure the most suitable deal—one that gets approved and aligns with your financial goals.

If you're unsure whether the rates you're seeing are truly right for you, get in touch today for a no-obligation chat. We're here to bring clarity and confidence to your mortgage journey.